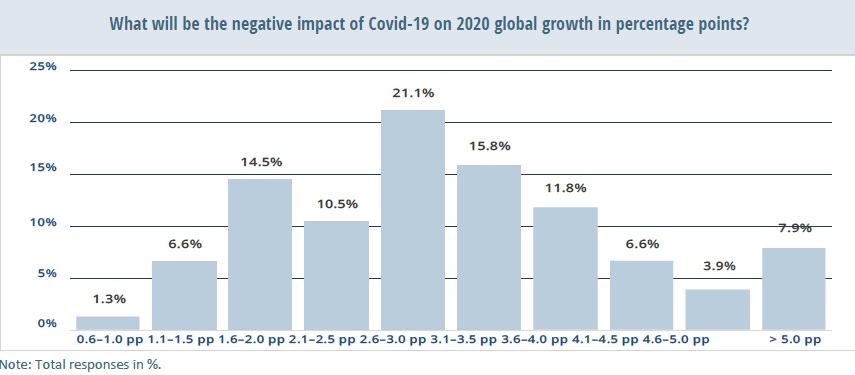

Economists have downgraded their forecasts for the global economy, as economic data-such as PMI readings and U.S. jobless claims-began to reflect the severity of the coming downturn. According to 6-7 April survey of 77 panelists, close to half now see the coronavirus pandemic hitting 2020 global growth by more than three percentage points, 74% of panelists expect the negative impact of Covid-10 to drag into 2021, up from 68% in last week’s report.

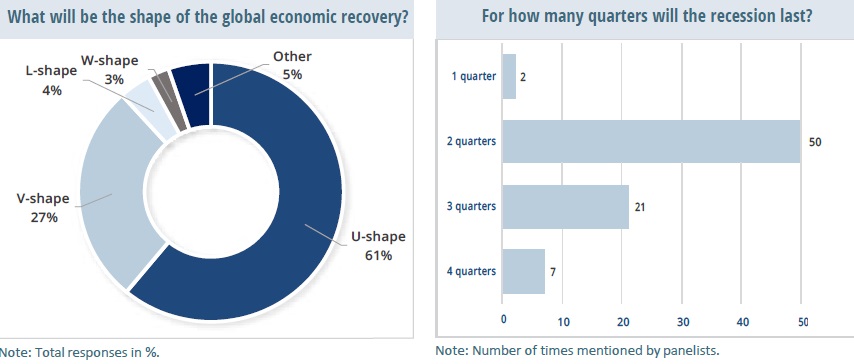

Most economists continue to see a global recession lasting for two quarter. However, compared to last week’s survey more panelists now expect a longer downturn, and risks are clearly skewed to the downside given uncertainty over the evolution of the pandemic, the duration of worldwide containment measures and the effectiveness of stimulus packages. Relative to last week’s report, a larger share of panelists now see a U-shaped recovery. This implies economic activity will not suddenly rebound (referred to as V-shaped recovery) but will instead stay subdued for longer.

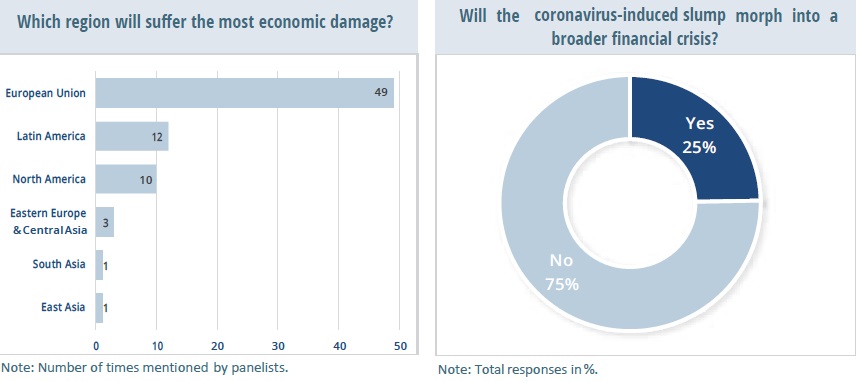

The European Union in expected to be the region that suffers the most economic damage, due to widespread lockdowns hurting an already-weak economy, and the lack of a of a coordinated fiscal response among member states. However, a significant minority of panelists see Latin America and North America being the most affected regions, due to weak healthcare systems and a sluggish response to the outbreak respectively.

A large majority of panelists do not see the coronavirus-induced downturn morphing into a broader financial crisis, thanks to huge stimulus and better-capitalized banks compared to the Global Financial Crisis. However, some economists continued to highlight high debt levels as key risk factors which could trigger a broader crisis.