TRATON SE begins the year with a plus in profits of 22%

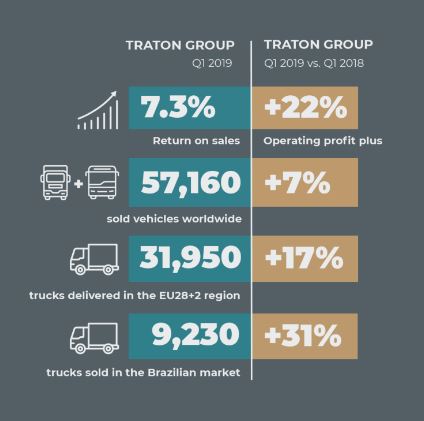

TRATON SE is off to a strong start in 2019. During the first quarter of 2019, the TRATON GROUP increased its operating profit by 21.9% compared with the prior-year quarter to €470 million. All three brands MAN, Scania, and Volkswagen Caminhões e Ônibus contributed to this positive result. Sales revenue rose by 6.0% year-on-year to €6.4 billion across all brands. During the first three months of 2019, the TRATON GROUP sold 57,160 vehicles worldwide, up 7.4% against the prior-year figure. This growth was primarily supported by the continued favorable development of the core markets of Europe and Brazil.

Andreas Renschler, the CEO of TRATON and a member of the Board of Management of Volkswagen AG, said: “We continue to pursue our profitable growth path we set out on when our Group was established. The Group recorded the highest-ever unit sales in a single quarter. Our further aim remains very clear: we want to be an independent Global Champion in the transportation industry. With the full support of Volkswagen AG, we continue to work on implementing our strategy.”

With its brands MAN, Scania, and Volkswagen Caminhões e Ônibus, the TRATON GROUP is a leading commercial vehicle manufacturer worldwide, pursuing the goal of creating a Global Champion in the industry through profitable growth, customer-centric innovations, and global expansion. The Group posted operating profit of €470 million, which is reflected in an operating return on sales of 7.3% (previous year: 6.4%).

Christian Schulz, CFO of the TRATON GROUP, said: “We’ve got momentum. TRATON is off to a good start in 2019; with an return on sales of 7.3%, it is trending at the upper end of the set target range of between 6.5% and 7.5%.”

The TRATON GROUP operates in two segments: Industrial Business and Financial Services. The Industrial Business comprises the three operating units MAN Truck & Bus, Scania Vehicles & Services, and Volkswagen Caminhões e Ônibus. During the first quarter of 2019, the Industrial Business segment generated sales revenue of €6.3 billion, with an operating profit of €438 million (previous year: €351 million).

Net cash flow for the first quarter 2019 amounted to €1.6 billion, largely favored by the sale of the Power Engineering business area to Volkswagen AG. Adjusted for this factor, cash flow amounted to

€–0.4 billion, which was impacted disproportionately by the inventory build-up at all brands. This build-up is seasonal in nature and is heightened as a result of having remedied supplier bottlenecks in the production process at Scania. The lead time in the delivery process has been streamlined as a result. The TRATON GROUP continues to focus on the target range for the cash conversion rate (percentage of net profit converted to free cash flow) of 30–40% for 2019.

The Financial Services segment offers customers a wide range of financial services, including dealer and retail financing, leasing, banking, and insurance products. In the first three months of 2019, this segment recorded an operating profit of €33 million (previous year: €29 million) and sales revenue of €203 million (previous year: €179 million).

MAN is a reliable full-service provider with the aim of supporting and facilitating its customers’ business operations. At 24,970, MAN registered the most vehicle deliveries among the TRATON brands, selling significantly more vehicles in the first quarter of 2019 (+13%) than during the same period in the previous year. In addition to the boost in the sales of trucks, the MAN TGE van series contributed continued significant growth. Sales revenue of the MAN Truck & Bus operational unit rose by around 7% to €2.6 billion. The operating profit increased by around 30% to €122 million, with operating return on sales of 4.7% (previous year: 3.8%).

The Scania brand is the premium innovation leader of sustainable transportation solutions. At 23,580 trucks and buses, Scania delivered more vehicles in the first quarter than in the same period last year (+4%). Sales revenue of the Scania Vehicles & Services operational unit rose by around 11% to around €3.4 billion. Operating profit increased by around 24% to €370 million, as a result of higher vehicle and service volume and a positive currency effect. The operating return on sales of Scania Vehicles & Services for the first three months of the year was 11.0% (previous year: 9.9%)

VWCO has continuously held a leading position in the Brazilian truck market over the past 15 years. In the first quarter, demand for VWCO vehicles increased by just over 12% to 9,840 units. Improved pricing in the local Brazilian market and a favorable product mix contributed to the more pronounced increase in sales revenue of 21% to €416 million. VWCO recorded operating profit of €8 million, with operating return on sales of 2.0% (previous year: 0.5%).

Despite the overall favorable sales performance during the past three months, the high pace of growth of the past years has slowed slightly.

During the first quarter 2019, truck unit sales of the TRATON brands increased by around 10% to 52,950 vehicles. This includes the MAN TGE van series (3,120 units), which recorded continued significant growth. Deliveries of buses were down by approximately –18% to 4,210 units due the decline in the Middle East, Africa and Russia.

Truck sales performance (not including MAN TGE) varied by region, while TRATON benefited from the strengths of its core markets. Thus TRATON, together with its MAN, Scania, and VWCO brands, remains the leading supplier in the EU28+2 region (EU, Norway, Switzerland) with 31,950 trucks delivered. The year-on-year increase of just over 17% was bolstered by slight growth experienced again in the European commercial vehicles market, with Germany in particular driving growth.

TRATON remains a leader in the Brazilian truck market. The economic upturn in South America’s largest economy as the most important single market had a particularly positive impact on the commercial vehicle sales of VWCO. Unit sales in Brazil rose by around 31% to 9,230 vehicles. By contrast, in Argentina, the sharp deterioration of the overall economic climate led to a considerable decline in deliveries. In total, the brands sold 10,400 trucks in the South America region, representing a year-on-year increase of about 10%.

In other regions in the world, deliveries in particular in the Middle East region fell by about 54% against the prior year to 910 trucks – due primarily to the economic development and weaker demand in Turkey.